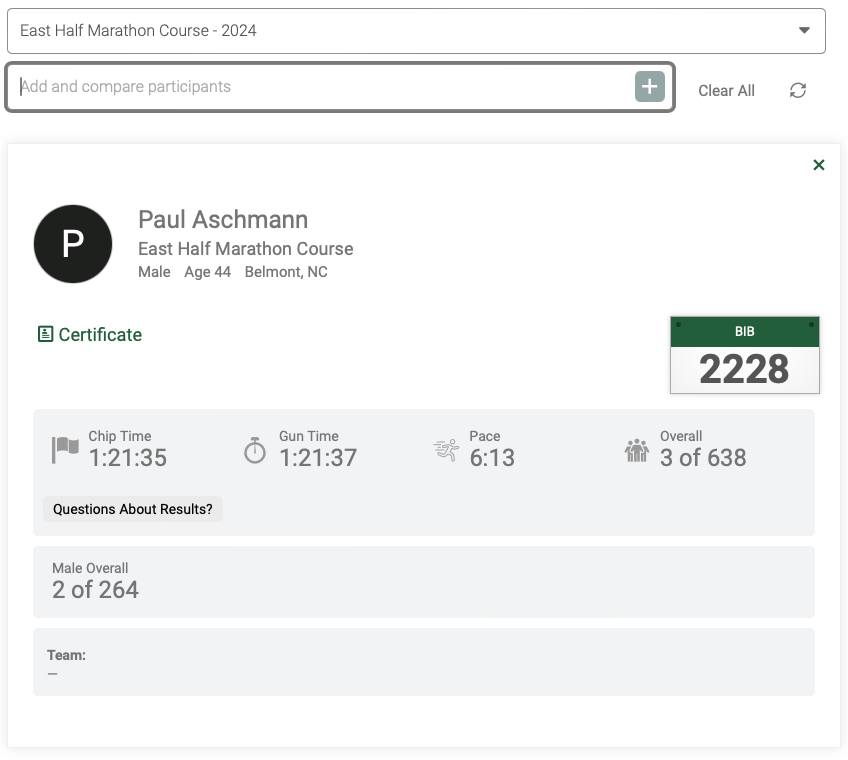

Super interesting article on the use of Hypoxanthine (from sweat) being used as a predictor of performance in athletes.

Having done HR tracking, Power and over the last couple of years, Lactate, it’s always interesting to hear of new methods and advancements in performance, and opportunities to improve metabolic health. So while I am still waiting for a reasonable/practical real-time Lactate monitoring solution, maybe I should skip to the next big thing …

Check it out here: https://pubmed.ncbi.nlm.nih.gov/23670363/

Abstract

Purine metabolism reflects the exercise-induced muscle adaptations and training status. This study evaluated the utility of plasma hypoxanthine in the prediction of actual sport performance. We studied male athletes: 28 triathletes (21.4±2.9 years), 12 long-distance runners (23.2±1.9 years), 13 middle-distance runners (22.9±1.8 years) and 18 sprinters (22.0±2.7 years). Season-best race times were considered, achieved over standard triathlon, 5 000 m, 1 500 m and 100 m, respectively. Incremental treadmill test was administered to determine maximum and “threshold” oxygen uptake. Resting and post-exercise plasma concentrations of hypoxanthine, xanthine, uric acid and lactate were measured as well as resting erythrocyte hypoxanthine-guanine phosphoribosyltransferase activity. Simple and multiple regression analyses were used to identify significant contributors to the variance in performance. Hypoxanthine considered alone explained more variance in triathletes, long-distance runners, middle-distance runners and sprinters (r 2=0.81, 0.81, 0.88 and 0.78, respectively) than models based on aerobic capacity and lactate (R 2=0.51, 0.37, 0.59 and 0.31, respectively). Combining purine metabolites and cardiorespiratory variables resulted in the best prediction (R 2=0.86, 0.93, 0.93 and 0.91; r=0.93, 0.96, 0.96 and 0.95, respectively). In summary, hypoxanthine is a strong predictor of performance in highly trained athletes and its prediction ability is very high regardless of sport specialization, spanning the continuum from speed-power to endurance disciplines. read more