| Types of negotiations:Distributive:One person gets more than anotherIntegrative:Can be used when other party is willing to problem solveThere is trustLong term relationship is importantA good agreement is better than a quick or bad oneHow To:Create a free flow of informationAttempt to understand the other persons real needs and objectivesEmphasize commonalities between the partiesSearch for solutions that meets both goals and objectives | Conventional Negotiations* Focus on winning* Assert positions/personal preferences* Concede stubbornly* Seek arbitrary compromises* Engage in threats, bluffs or similar tactics |

| 4 principles of effective negotiation* Separate the people from the problemListen activelyAcknowledge perceptions and emotionsSpeak about yourself, not them* Focus on interests, not positionsInterests:Often more than oneCan changeOften stem from deeply rooted human needs or valuesTypes of interests:Substantive: How people describe the issueRelational: How people think they should be treated or acknowledgedProcedural: How people think issues should be addressed | * Invent options for mutual gainAvoid assuming there is a single solutionThink creativelySeparate brainstorming from evaluating optionsInvent options by redefining the problem:* Compromise* Logroll: give up what you want to get what you need* Expand/Modify the pie: increase the mutual gain by making the pie bigger, but still having the same percentage share* Find a bridge solution:Bogey technique inflate importance of something NibbleSnowballUltimatumAnchoringHypothetical* Insist on objective criteriaFair standardsMarket value, best practices, industry averages, equal treatment etc.Fair proceduresTake turns, last best offers |

| Evaluate and Select AlternativesNarrow the range of solution optionsEvaluate based on quality, objective standards, acceptabilityAgree to evaluation criteria in advanceBe alert to the influence of intangibles!!! | Develop a BATNAWhat would you do if you fail to reach an agreementConvert the most promising options into practical choicesIf an offer is better than the BATNA, consider selecting it, otherwise consider rejecting it. |

| Framing* Represent the subjective mechanism through which people make sense out of situations* Lead people to pursue or avoid subsequent actions* Focus, shape and organize the world around us* Make sense of complex realities* Define a person, event or process | Reframing an offer:Ask why did you select that number?What if we agree to your offer, but you cover a warranty and service? |

| Cognitive Biases* Irrational escalation of commitmentCommit to a course of action even when that commitment is irrational* Anchoring and adjustmentStead fastThe anchor might be based on faulty of incomplete info* Issue framing and riskFraming can lead people to seek, avoid or be neutral about risk* Availability of informationInformation presentation can sway choices* OverconfidenceTendency to believe that their ability to be correct is greater than it actually is | The law of small numbersThe tendency of people to draw conclusions from a small sampleSelf serving biasEndowment effectThe tendency to overvalue something you own or believe you possesReactive DevaluationDevaluing the other parties concessions simply because they made them |

Category: MBA

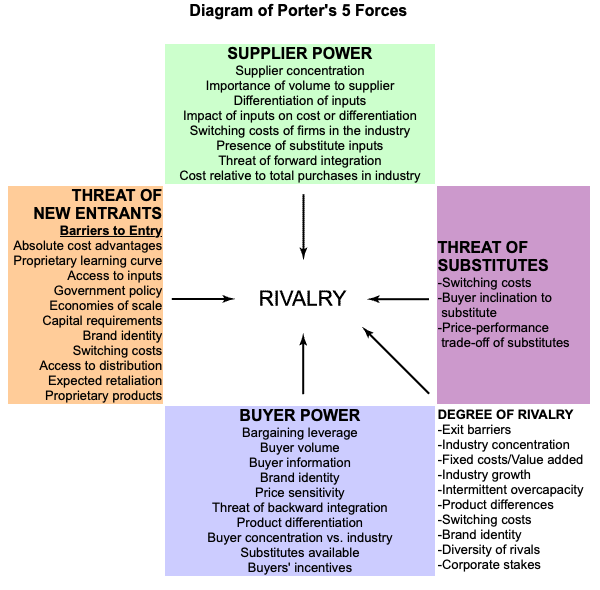

Porters 5 Forces

During my MBA, one of the classes which really resonated and appealed to me was Global Strategic Management. During the class we utilized a model called Porters 5 Forces to evaluate a companies strategic and competitive advantage.

This diagram nicely summarizes the model:

Here are a few papers and docs I wrote which use this:

Here are papers which I did not write, but found relevant since they also use Porters 5 forces for analysis:

- Amazon (2014)

- QuintilesIMS

MBA: Lucchetti Case Study

- Company in Peru

- Consumer product packaging sector

- Luksic group subsidary (purchased in 1965)

- Lucchetti

- Founded in 1900’s

- Pasta, edible oils, soups and broths

- Known for quality, nutritional value and competitive prices.

- Multiple household names

- 1996 had 38% of chilean pasta market

- Wanted to get into Peru for expansion

| Company Analysis | |

| Business model | |

| Other notes | Founded in 1900’sPasta, edible oils, soups and brothsKnown for quality, nutritional value and competitive prices.Multiple household names1996 had 38% of chilean pasta marketWanted to get into Peru for expansionPremium brandBusiness started in June 1995Decided to build plant in 1996 (due to new import duties and growth) seemed approval before starting etc.Assigned Carlos Aramburu to oversee environmental concerns of constructionInitially imported products from ChilePartnered with a distribution firm for direct sales and distribution |

| Internal Environment Analysis | |

| Strengths | Part of existing conglomerate (diversified holdings)Newer / optimized production processesDistribution and service networkGrowing market share despite factory issuesEnd of 1998 had 23% market share |

| Weaknesses | Import dutiesNet losses of 15$M 1999Sales decline in 2001 from 45m to 34 (still had $6 profit)Major losses from operations 61M.No political connections? |

| General Environment Analysis | |

| Opportunities | High consumption rates of 8 to 9 KG per capita per yearPasta normally sold in build, packaged pasta relatively newLow qualityAnticipated a growing economy price increase and demand increaseTax and repatriation benefits |

| Threats | Possibly being targeted by politicians during building expansion as other companies were not being scrutinized (3M, KMB, etc.)Price warCompetitorsAdditional increasing import duties (18 to 25% of wheat) Negative publicity from MotesinosNational level support, but not at the local level |

| Industry Environment Analysis | |

| Social/Cultural | Majority of food sold in neighborhood markets and mom-pop stores10 % sold in supermarkets |

| Political/Legal | Peru encouraged external investment through tax incentivesRepatriate profitsNo discrimination between local and forgein in investorsFujimori president elected in 90’s, reelected after some constitutional changes in 95.Major Anti corruption campaign Made it tough for the domestic manufacturers, workers and poor2000 major political upheval |

| Economic | Growing economy |

| Global | |

| Demographic | Lower income nation |

| Porters 5 Forces Model | |

| Bargaining Power of Buyer | |

| Bargaining Power of Supplier | |

| Threat of new Entrants | |

| Threat of Product Substitutes | |

| Inter firm Rivalry | |

| Competitor Environment | Producing lower quality pasta in older factoriesLess optimized production facilities |

| Alicorp – 3000 pound gorilla in Peruvian pasta market4th largest company in PeruEconomies of scalePort handlingflourCookies and crackersEdible oils etc.Massive distribution network reaching 90% of POSAlso built a new plant in 1997 | |

| Carrozzi – Lucchettis main competitor in ChileAlso entered PeruEntry mode AcquisitionPurchased company Molitalia (18% market share)Didn’t build a new factory or change its name | |

| Molitalia | |

| Competitive Advantage | |

| Valuable | |

| Rare | |

| Imperfectly Imitable“Costly to imitate” | |

| Non-Substitutable | |

| Recommendations | Could have made a better bid for local companyBetter competition analysis of AlicorpMisjudged external environment (specifically political situation) |

MBA: Should IMAX expand to BRIC Economies?

BRIC = Brazil, Russia, India and China

2013 Richard Gelford CRO of IMAX wanted declared the only way to becoming a billion dollar company was to grow outside of the US.

- flat five year box office trend in North America versus double digit growth in Asia Pacific and Latin America

- China had 221 IMAX screens in 2014 (2nd to US)

- Prior to 2001 IMAX was an expensive capital investment

- Came up with Digital remastering to convert firms relatively cheaply and quickly

Business Model

- Revenue Sharing

- IMAX would provide free equipment in return for 1/3 of box office receipts – 10-13 years. Also licensed its technology through leases and sales.

- 2009 Avatar grossed $250 million on IMAX

- 1 in 5 selected to shoot with IMAX cameras

MBA: EMS Product/Innovation

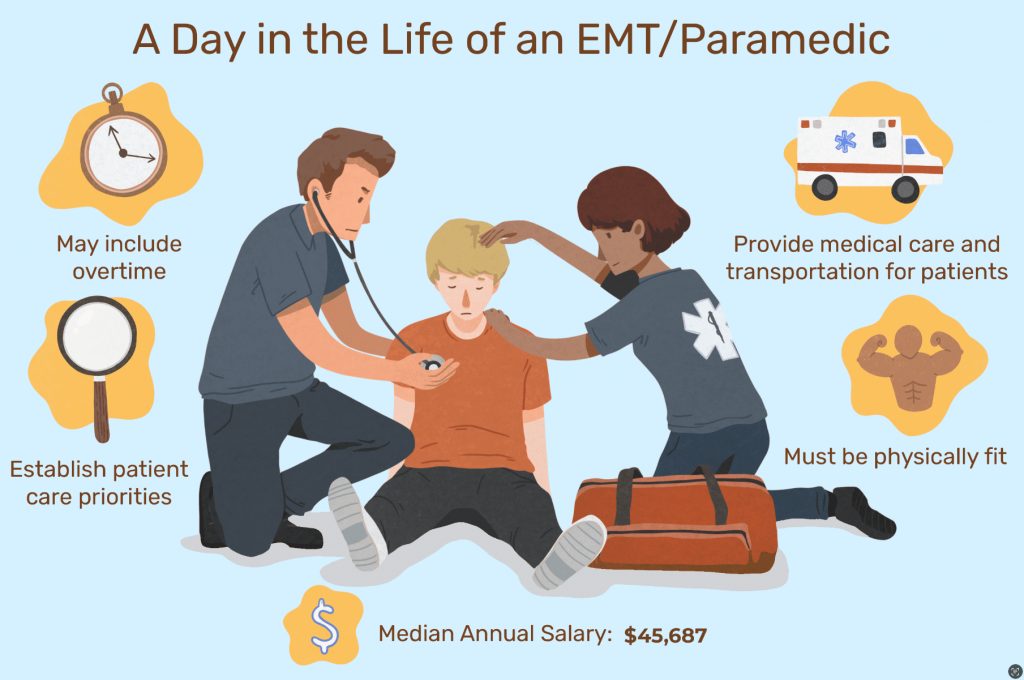

During my MBA, I took a class on Design Thinking. While not new to me (I originally learned and utilized design thinking in 2011 at a SAP TechEd Innojam event) I wanted to reaffirm and gain deeper understanding into some of the theoretical aspects of the methodology.

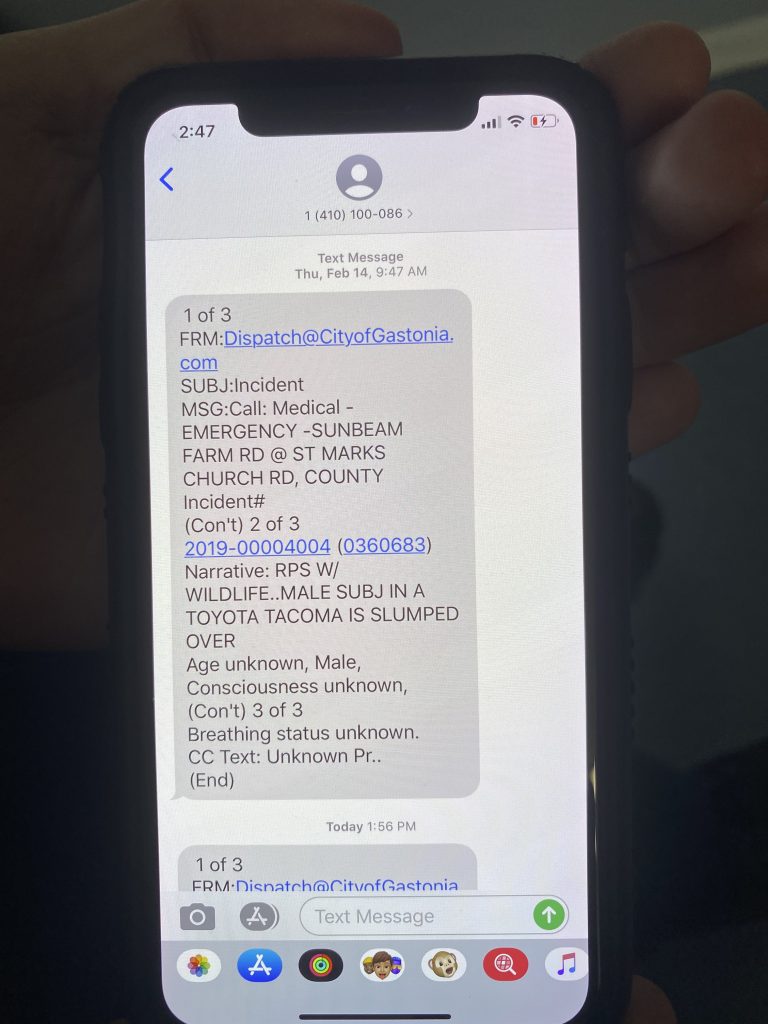

During the class, a final project was to reimagine and apply our design thinking skills to a public service organization. We decided to center our project around the Emergency Medical Services industry. While it was probably not my first choice in problems to design around, it has been an eye opening experience to one of the most mentally challenging jobs I have personally come across. I have lived less than a mile from a life saving station for the past 5 years. I have heard the sirens of their ambulances morning, noon and in the middle of night. I have driven past their station hundreds of times and have always appreciated and been thankful for the work they have done, but I honestly never completely understood the scope of their work until spending a few hours interviewing and reading interviews of 11 different EMTs and Paramedics from Gaston and Mecklenburg counties. Each person’s story was unique, each had their own personal struggles and challenges. Below are a few which stood out to me and something I believe will be in the back of my mind each and every time I see or hear a siren.

MBA: Case Study Template

| General Environment |

| Social/Cultural |

| Political/Legal |

| Economic |

| Global |

| Demographic |

| Internal Environment |

| Strengths |

| Weaknesses |

| Competitive Advantage |

| Valuable |

| Rare |

| Imperfectly Imitable“Costly to imitate” |

| Non-Substitutable |

| Industry |

| Inter firm Rivalry |

| Bargaining Power of Buyer |

| Bargaining Power of Supplier |

| Threat of new Entrants |

| Threat of Product Substitutes |

| Competitors |

| Company Strategy |

| Recommendations |

Here is an example of a case study I created using the outline:

Case introduction:

PKG Capital a large US based Private Equity firm has a substantial stake in Kraft Foods since 2001 (@ $31 ps) and are considering selling their share. This is after Kraft share price is declining and there had been a friendly, then subsequently hostile takeover bid to purchase Cadbury’s.

Cadbury’s is in the confectionary space and includes products such as Chocolate (48.6%), gum (12.5%) and sugar treats (34.6%), with cereal bars the remainder.

COGS: ~ 35%

33% Asia, 30% sugar comes from South America

Cocoa from Africam Asia and South America

| Strengths | Growing confectionary market @ 3%3 largest purchase category behind soda and milk.Market leader in the Chocolate category, which accounts for 48.6%Positioned for greater margins. (Commodity prices are in decline reducing COGS) |

| Weaknesses | Retailers making 30% margin and squeezing manufacturers (who make 12%)Single industry (not diversified)Private labelsLow barriers to entry for new playersHigh capital and overhead costs which require high utilization to offset the overhead and operational costsRequires brand constant innovation and marketing to stay relevant due to appeal being driven by brand advertising and packaging. |

| Competitive Advantage | |

| Valuable | Brand |

| Rare | |

| Imperfectly Imitable“Costly to imitate” | |

| Non-Substitutable | |

| Social/Cultural | Health product revolution – smaller portion, fat content. CSR |

| Political/Legal | Their position as a major employer in BritainKraft is a US company and taking over a national brand |

| Economic | Market decline in 2008 |

| Global | Corporate social responsibility, fair trade |

| Demographic | |

| Bargaining Power of Buyer | High, lots of suppliers of RM’sFactories close to suppliers |

| Bargaining Power of Supplier | Low, options |

| Threat of new Entrants | High – anyone can technically make chocolate, but obviously scale is not easy |

| Threat of Product Substitutes | High – Health conscious alternatives, power bars, etc. |

| Inter firm Rivalry | High – retail space is a constant battle for shelf space |

| Competitors | |

| Company Strategy | Kraft – 4 building blocks |

| Recommendations | From a manufacturer’s perspective, how attractive is the global market for confectionary?Why has Cadbury become a takeover target?Why does Kraft want to purchase Cadbury? Does the proposed deal make sense for Kraft? How about for Cadbury?What is Cadbury’s value to Kraft? In other words, what should Cadbury’s purchase price be?Economies of scaleDo exist. As a ordinary Food manufacturing industry, confectionaryindustry also has economy of scale. Large amount of output lower costs ofnearly all functions of production process. Buying more ingredient can directly bring in a bargaining advantage when negotiating with suppliers,and a large amount of output makes a high-cost production line worthwhile,So there will be less need of labor and better standardized products. 1.2Product differentiationNot vary high. Though Cadbury has its own brand of chocolate, the recipeof chocolate doesn’t differ much in The industry. 1.3Capital requirementsVaries. Confectionery can be a one-person corner shop to a giant globalcompany like Cadbury, Mars and Nestle. In China, starting up a smallestcandy shop Only needs less than 100000 yuan (about 14529 US dollars).1.4Switching costsHigh. Production lines and invisible assets like recipe or production patent of a confectionery company are usually highly specified, so that cannot be easily used for other needs.1.5Access to distribution channelsHigh. Current confectionery manufacturers mostly rely on wholesalers andother middleman to deliver their products from factories to supermarketsand grocery stores. And these middlemen are willing and happy to signcontract with many different brands in order to provide a wild range ofproducts to its customers. Confectionery ingredients are all standard andlack of differences, so there are nearly zero switching cost about theseproducts.1.6Access to raw materialsEasy. Candy and chocolate require no unusual materials, it only needssugar, coco beans and some food additives. It is not complex nor difficultfor new entrants has its access to raw materials |

MBA: Sherwood Hockey

Strengths:

- Reputation/l High quality wooden sticks

- Composite sticks

- Canadian

- Learning by partner

- Quick turn around

- Long relationship

Weaknesses:

- Lack of endorsements

- Limited use in NHL

- Costly turnaround

- Decreasing sales/margin

- Limited brand recognition outside Canada

- No product personalization

- Reputation not good with outsourcing

Anki – Learning

I have a terrible memory and it is one of the main reasons I have this blog … while going through my MBA, I resorted to learning via the Anki memory recognition method. Here are a few resources I collected during this journey:

Plaid

Plaid is a company in the financial technology, or more commonly known as the “fintech” space, which was founded in 2013, pivoted sometime in 2014 and was purchased by Visa in January 2020 for $5.3 billion dollars.

Plaid was founded by two entrepreneurs who set out to develop a consumer app in the budgeting and account reconciliation field. A mobile or app-based version of Quicken or Intuits Quick Books where users could provide their credit cards and bank account and the interface would allow them to get some insights into their spending habits and create budgets and reports to better manage their personal finances. The startup entered and won a prestigious grand prize award during a TechCrunch Disrupt hackathon in New York in 2013 with their application which at that time was called “Rambler”. During the development process the founders recognized that one of the biggest challenges to building “Rambler” was the bank connectivity component – it was time consuming and resource intensive to develop a solution which connected to each financial institution. The duo wanted their application to connect to the majority of US banks and this required writing code which would need to securely connect and consume the banks exposed API’s for retrieving account information, transaction reports and transaction details. This development exercise was required for each new financial institution the company wanted to include in their app.

Whole Foods – Case Study

Notes: (Paper below)

John Mackey started Safer Way in 1978 focused on entirely vegetarian foods. Joined forces with Craig Weller, Mark Skiles who founded Clarksville Natural Grocery Store in 1979. JV took place in Austin, TX with 19 people. Whole Foods also owns and operates several subsidiaries – e.g. Allegro Coffee, Pigion Cove. Company has 8 distribution centers, 7 regional bake houses and 4 commissaries.

Company is highly selective about what they sell – stringent quality, sustainable agriculture.

WF products differ by geographic regions and local farm specialities.

Company tries to instill a sense of purpose among its employees – 100 best companies to work for. 90% enjoy their job.

You must be logged in to post a comment.