Notes: (Paper below)

John Mackey started Safer Way in 1978 focused on entirely vegetarian foods. Joined forces with Craig Weller, Mark Skiles who founded Clarksville Natural Grocery Store in 1979. JV took place in Austin, TX with 19 people. Whole Foods also owns and operates several subsidiaries – e.g. Allegro Coffee, Pigion Cove. Company has 8 distribution centers, 7 regional bake houses and 4 commissaries.

Company is highly selective about what they sell – stringent quality, sustainable agriculture.

WF products differ by geographic regions and local farm specialities.

Company tries to instill a sense of purpose among its employees – 100 best companies to work for. 90% enjoy their job.

Treat customers as “lifeblood of their business” and are interdepended on each other.

Competitive Environment

Inception = no competition, population is becoming increasingly concerned about eating habits, natural foods are flourishing. e.g. Trader joes and Wild Oats Market.

Only 3% of US Farmland is organic?

Low price and convenience continue to be the dominant factors driving consumers to supermarkets today. Characterized by Low margins and downward pressure on prices.

A different shopping experience

Setup store is different. Store and products carefully researched to ensure its meeting the demands of local community. In stores chefs to help with recipes, wine and food sampling.

WF uses price as a marketing tool – 365 WF brand names priced less than similar organic products. Does not use price to differentiate from competitors, it focuses on quality and service as the competitive dimensions.

It relies on word of mouth and is promoted in health magazines.

WF is recognized for charitable contributions, 5% of after-tax profits to non-profit charities.

The aging baby boomers

Aging baby boomer generation will expand and the urban singles are focuses for WF due to extra disposable income. Americans spend 7.2% on food. Increase in income and other items has created an expansion in gourmet store market and slowing discount retail market.

“People don’t shop our stores because we have low prices” – Mackey

Growth of natural foods is expected to continue at a rate of 8-10% annually.

Operations

Purchases food from regional and national suppliers. Allows company to leverage size in order to receive deep discounts and favorable terms.

Owns 2 procurement centers and handles majority of procurement and distrubtion itself.

Prepared food sales is a large opportunity.

Code of Conduct

Heavy focus on ethics. Animal rights and opposes animal cruelty. 14 page code of conduct document.

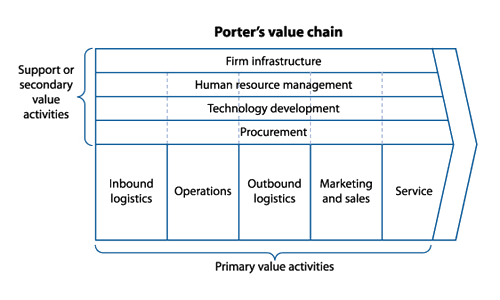

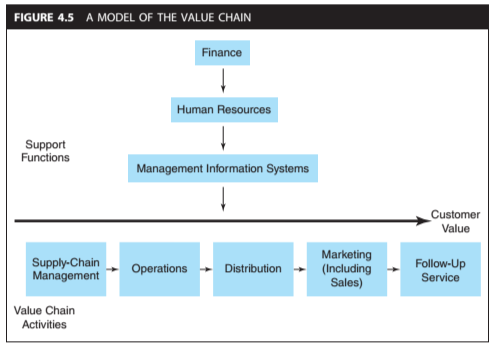

Evaluate Whole Foods’ value chain.

- Strong revenue growth

- Wide range of products and value added services

- Dedicated workforce

Porters 5 forces of competition

Does Whole Foods have a source of competitive advantage?

Although the grocery market is highly competitive, WF’s brand of being sustainable and consumer conscious is a competitive advantage.

What are the major strategic risks facing Whole Foods?

Competitive Dynamics, adoption of very similar practices by other stores.

What strategic options are available for Whole Foods going forward?

Continue with their business-level strategies which allow them to differentiate from others. Focus on their product and service quality dimensions to be competitive in addition to the products.

Consider new strategic alliances with companies and brands which have similar interests, vision and goals.

Paper:

External Environment Analysis; General Environment Analysis; Political/legal – The US Dept of Agriculture specifies guidelines for organic and natural foods. These guidelines could become tighter, and supply is already very small (3% of production dedicated to organics). Technological – No major trends to note. Sociocultural – Health concerns have long driven food purchase, but organics represents a relatively new niche. More women in the workforce presents an opportunity for prepared meals. Economic – WFMI has weathered a tough economy, but should be concerned if economy were to face a significant long-term downturn. Global – Information suggests that there might be potential opportunity outside of US, with WFMI’s moving into UK and Wild Oats in Canada. Demographic – Aging baby boomers and urban singles are both growing demographics with discretionary income and a health conscience that present opportunities for the organics niche. Overall, the general environment presents significant opportunity for growth.

Industry Environment Analysis; Bargaining power of suppliers – A high threat for the industry overall as suppliers are providing a critical supply that is high in demand (and increasing) and short in supply. WFMI’s existing strong relationships with suppliers should offset this threat. Bargaining power of buyers – The buyers are individual consumers. This is not a concentrated buyer group, but there are low switching costs, so buyers do have bargaining power (i.e., a moderate threat). But, WFMI’s brand loyalty should reduce this threat. Threat of new entrants – Very high, as evidenced by the industry-wide competitors coming into the niche. Capital requirements are relatively low (a high threat), but WFMI’s differentiation strategy will maintain customer loyalty. Interfirm rivalry – Historically, interfirm rivalry has been low as this is a young industry and there has been sufficient room for competitors to grow. As the ideal markets are being filled, competitors will begin to encroach on each others’ markets, leading to more competition going forward. Given its strong brand and differentiation strategy, WFMI might be more immune to a price war than its competitors, but it still needs to be cautious as it has high strategic stakes in the organics niche (i.e., it is not diversified). Right now, this industry force is an opportunity, but this is evaporating rather quickly. Threat of product substitutes – Natural foods and general groceries are the main product substitutes. This threat is low for more educated consumers but high and remaining so for the general consumer. The industry is mixed, but is becoming less attractive. WFMI should be well-positioned given its differentiation.

Competitor Environment; Trader Joe’s – a privately-held firm with more, but smaller stores than WFMI, also enjoying growth but pursuing what appears to be a cost leadership strategy.

Wild Oats – 3rd-largest competitor behind WFMI and Trader Joe’s, Wild Oats is a publicly held firm with stores in the US and Canada that is also enjoying growth. Wild Oats provides both organics and general groceries, and is working to strengthen and streamline its operations. Leadership is less familiar with the organics niche. General grocery stores – Historically not competing in organics niche, these competitors have recently seen the growth and value creation within the niche as very attractive and have begun entering the niche by offering organics in their existing stores. These competitors are much, much larger and often compete on price.

Internal Environment Analysis

Strengths – WFMI has vertically integrated (i.e., bakeries, fisheries, etc.), gaining market power and control over supply and reducing intermediary costs. WFMI was an early mover into the organics niche and has been able to capture a significant footprint before competitors. Also, see value chain below. Weaknesses – CEO Mackey has been a truly entrepreneurial CEO, having the alertness to identify higher-margin products and ways to increase supply control and reduce intermediaries. In addition, he knows how to target his customer niche. See value chain.

Value Chain; Supporting activities: Administration: Historically, a strength given market knowledge and awareness of opportunities for growth/efficiency, but potentially a weakness given the need for greater operational efficiency going forward; Human Resources: A strength evidenced by training of employees, cleanliness of stores and other promotions, and employee satisfaction; Procurement: Whole Foods has vertically integrated, gaining control of key supply. Where it doesn’t have control, Whole Foods has strong relationships with suppliers, evidenced by suppliers’ willingness to incur/share costs of stocking new stores. Primary activities: Inbound logistics: A strength given proximity to suppliers and relationships with suppliers; Operations/outbound logistics/service: Key knowledge in how to manage perishables and also ownership of own brand goods; clean stores and key promotions also entice customers; Its own stringent quality standards maintain customers’ quality perception; Marketing: Historically a strength given word-of-mouth marketing is arguably the most trustworthy form of marketing, but it’s also relatively slower, and given the growth plan and new competition, this could potentially be a weakness going forward. Competitive Advantage – WFMI has a source of sustainable competitive advantage, given that its relationships with suppliers and supply chain/operational knowledge of perishables facilitate reduced product loss and brand name reputation attracts customers willing to pay a premium (valuable). There are currently only a few competitors in the organic niche, and given the information, it appears that WFMI is perhaps the only one (rare) investing heavily in providing premium products/services via supplier relationships, knowledge investments, and its culture, all of which are causally ambiguous and/or socially complex, and leading to a path dependent brand name/reputation (inimitable). WFMI has leveraged its first mover advantage to grow quickly and establish a sizable footprint that remains rare. While this rarity is decreasing, WFMI’s reputation and relational/operational competencies will be difficult and costly to imitate. The strategic concern is less the substitution of WFMI’s goods by general groceries at this point, but the substitution of WFMI’s premium service by the convenience of industry-wide competitors. For the most part, WFMI’s value chain is aligned with its business-level strategy in terms of providing a focused, differentiated product (organizational in VRIO). WFMI invests in its value chain to provide a premium product targeting the organics niche.

Strategic Issue – Business-Level Strategy

Whole Foods is leveraging a focused-differentiation, business-level strategy. Whole Foods is focused on the organic niche of the grocery industry, seeking to provide a premium quality of products (i.e., goods and services).

This strategic choice has presented a number of benefits to Whole Foods. By focusing, Whole Foods has been able to narrow down to a particular segment of customers, tailor products more effectively to these customers’ needs, target investments more effectively in terms of marketing, and make operational/location-based decisions more precisely. By locating close to their target market, customers have the discretionary income to pay a premium and an educational awareness to understand the benefits of Whole Foods’ products. Being differentiated, customers are loyal and actually spread the word via word-of-mouth marketing that has facilitated significant growth, which will ward off competition from potential new entrants. Likewise, customer loyalty will allow Whole Foods to pass along rising costs of supply to its customers better than competitors.

However, there are significant risks associated with this strategic choice as well. To the extent that supply issues get way out of control, rising prices may lead even loyal customers to begin questioning the value of organics. That said, Whole Foods has very strong relationships with its suppliers that have the potential to reduce this risk. Questions could also be asked as to whether natural foods might reduce perceived quality of organics. Most importantly, however, industry-wide competitors have seen the value generated within and growth of the organics niche, and now they are beginning to enter this niche. Industry-wide competitors have a much larger footprint, which could lead to greater convenience for customers who are seeking to pick up just a few things at the store, and the industry-wide competitors will be much more knowledgeable about cost-based competition, which could potentially reduce the value perceived in Whole Foods’ products. To the extent that customers seek greater convenience of one-stop shopping for their organic and general groceries, this could lead a notable proportion of customer loss for Whole Foods. Whole Foods has a competitive advantage, so I don’t see failure in the near future for Whole Foods, but this is a significant competitive threat that could slow Whole Foods’ growth plans and overall performance, raising shareholder concerns.

Recommendation(s)

Whole Foods currently has a source of competitive advantage, but the firm is facing a dynamic external environment that poses new threats to the value of its competitive advantage. In particular, industry-wide competitors present a significant competitive threat given their size, marketing competencies, and efficiencies. This threat is exacerbated by weaknesses in Whole Foods’ value chain; in particular, its limited marketing competencies and an entrepreneurial CEO that does not have proven experience in terms of operational efficiency. Moreover, Whole Foods has saturated its “ideal” markets, suggesting that future expansion will likely lead the firm into more direct competition with competitors and/or into markets where customers are less educated/wealthy.

I recommend that Whole Foods seek to acquire a competitor in the organic foods niche. In doing so, Whole Foods can expand its geographic footprint much more quickly, thereby gaining market power and expanding its brand reputation as an early mover. The additional market power, while still relatively less than what will still be much larger industry-wide competitors, might be able to provide some buffer. Wild Oats and Trader Joe’s are the top two candidates discussed in the case. Both provide benefits and risks. Wild Oats is smaller and should be easier to absorb but would bring less market power, yet focuses on operational efficiencies (!), and has some diversification being in the US and Canada. Trader Joe’s is the larger of the two bringing more market power but presenting greater integration risk, and it is suggested that Trader Joe’s might have a cost leadership business-level strategy as well, which would philosophically conflict with Whole Foods if looking for a merger of the two brands but provide some related diversification. Ultimately, a top choice would be influenced by complementarity of their respective geographic footprints with WFMI, but Wild Oats would offer growth, brand extension, operational competencies, and more flexibility for going forward. The rapid growth provided by an acquisition would enable Whole Foods to leverage its existing source of competitive advantage (brand name/reputation; supplier relationships; organizational culture – VRI described previously) while filling key gaps in the firm’s value chain (strengthening the “O” in VRIN/O by adding operational competencies and building a larger geographic footprint).

Whole Foods is considering expanding internationally. Given the existing concerns in its domestic market, I believe these domestic concerns should take precedence, and Whole Foods should halt or significantly slow any international efforts and devote its resources to what would be a sizable acquisition.

In terms of the marketing concern, advancements in technology might allow mass distribution via email of promotions to existing customers, complemented by continued ads in health-focused magazines. Investing in marketing capabilities will enable Whole Foods again to strengthen key gaps in the firm’s value chain (strengthening the “O” in VRIO) that can enable the firm to continue sustainably leveraging its existing source of CA.

You must be logged in to post a comment.