I have also learned not to take glory in the difficulty of a proof: difficulty means we have not understood. The idea is to be able to paint a landscape in which the proof is obvious.”

Bodyweight Exercises

A nice chart showing various exercises you can do using just your body weight and which muscles they target. Helpful while traveling or weights and gym access is limited.

Bookmark: Open source graphs and visualizations

Gephi is the leading visualization and exploration software for all kinds of graphs and networks. Gephi is open-source and free.

Runs on Windows, Mac OS X and Linux.

Side Project: qubit²

Over the past couple of years I have had a keen interest in quantum computing and the optimism of its benefits over traditional computing methods. I have read countless papers, articles and spent a considerable amount of time deciding how I would explain it to a 5 year old.

ELI5: A normal computer is like a light switch is either on or off. A quantum computer is more like a dimmer switch, it can be partially on, or partially off.

It’s overly simplistic but gives a simple understanding of the potential states that the device can be in. I also wonder how I would explain QC to friends or technology friends. Trying to find the right words that quantify both its elementary simplicity and its quantitative complexity is difficult, especially when you yourself don’t fully grasp it. But like other technologies, the best way to learn is by doing … experimenting, researching and proofing. Leading to your own understanding and comprehension of existing anecdotes and theories or new ones.

Masayoshi Son

People usually compare the computer to the head of the human being. I would say that hardware is the bone of the head, the skull. The semiconductor is the brain within the head. The software is the wisdom. And data is the knowledge.

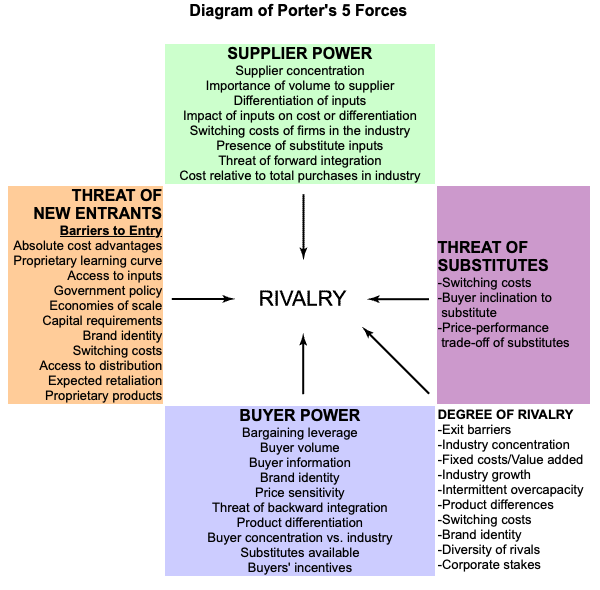

Porters 5 Forces

During my MBA, one of the classes which really resonated and appealed to me was Global Strategic Management. During the class we utilized a model called Porters 5 Forces to evaluate a companies strategic and competitive advantage.

This diagram nicely summarizes the model:

Here are a few papers and docs I wrote which use this:

Here are papers which I did not write, but found relevant since they also use Porters 5 forces for analysis:

- Amazon (2014)

- QuintilesIMS

MBA: Lucchetti Case Study

- Company in Peru

- Consumer product packaging sector

- Luksic group subsidary (purchased in 1965)

- Lucchetti

- Founded in 1900’s

- Pasta, edible oils, soups and broths

- Known for quality, nutritional value and competitive prices.

- Multiple household names

- 1996 had 38% of chilean pasta market

- Wanted to get into Peru for expansion

| Company Analysis | |

| Business model | |

| Other notes | Founded in 1900’sPasta, edible oils, soups and brothsKnown for quality, nutritional value and competitive prices.Multiple household names1996 had 38% of chilean pasta marketWanted to get into Peru for expansionPremium brandBusiness started in June 1995Decided to build plant in 1996 (due to new import duties and growth) seemed approval before starting etc.Assigned Carlos Aramburu to oversee environmental concerns of constructionInitially imported products from ChilePartnered with a distribution firm for direct sales and distribution |

| Internal Environment Analysis | |

| Strengths | Part of existing conglomerate (diversified holdings)Newer / optimized production processesDistribution and service networkGrowing market share despite factory issuesEnd of 1998 had 23% market share |

| Weaknesses | Import dutiesNet losses of 15$M 1999Sales decline in 2001 from 45m to 34 (still had $6 profit)Major losses from operations 61M.No political connections? |

| General Environment Analysis | |

| Opportunities | High consumption rates of 8 to 9 KG per capita per yearPasta normally sold in build, packaged pasta relatively newLow qualityAnticipated a growing economy price increase and demand increaseTax and repatriation benefits |

| Threats | Possibly being targeted by politicians during building expansion as other companies were not being scrutinized (3M, KMB, etc.)Price warCompetitorsAdditional increasing import duties (18 to 25% of wheat) Negative publicity from MotesinosNational level support, but not at the local level |

| Industry Environment Analysis | |

| Social/Cultural | Majority of food sold in neighborhood markets and mom-pop stores10 % sold in supermarkets |

| Political/Legal | Peru encouraged external investment through tax incentivesRepatriate profitsNo discrimination between local and forgein in investorsFujimori president elected in 90’s, reelected after some constitutional changes in 95.Major Anti corruption campaign Made it tough for the domestic manufacturers, workers and poor2000 major political upheval |

| Economic | Growing economy |

| Global | |

| Demographic | Lower income nation |

| Porters 5 Forces Model | |

| Bargaining Power of Buyer | |

| Bargaining Power of Supplier | |

| Threat of new Entrants | |

| Threat of Product Substitutes | |

| Inter firm Rivalry | |

| Competitor Environment | Producing lower quality pasta in older factoriesLess optimized production facilities |

| Alicorp – 3000 pound gorilla in Peruvian pasta market4th largest company in PeruEconomies of scalePort handlingflourCookies and crackersEdible oils etc.Massive distribution network reaching 90% of POSAlso built a new plant in 1997 | |

| Carrozzi – Lucchettis main competitor in ChileAlso entered PeruEntry mode AcquisitionPurchased company Molitalia (18% market share)Didn’t build a new factory or change its name | |

| Molitalia | |

| Competitive Advantage | |

| Valuable | |

| Rare | |

| Imperfectly Imitable“Costly to imitate” | |

| Non-Substitutable | |

| Recommendations | Could have made a better bid for local companyBetter competition analysis of AlicorpMisjudged external environment (specifically political situation) |

Our World in Data: Global living conditions

https://ourworldindata.org/a-history-of-global-living-conditions-in-5-charts

I often refer back to this data set when looking for statistics on the history of global living conditions. In times like these we sometimes need something positive to look at, and how far we have come. But as we have learned, history does not always predict the future. It will be interesting to see what impact COVID-19 has on the future of global health as we know it.

One of the more interesting stats from the data:

In 1997, the child mortality rate (< 5) was 8.37%, in 2017, it was 3.91%.

MBA: Should IMAX expand to BRIC Economies?

BRIC = Brazil, Russia, India and China

2013 Richard Gelford CRO of IMAX wanted declared the only way to becoming a billion dollar company was to grow outside of the US.

- flat five year box office trend in North America versus double digit growth in Asia Pacific and Latin America

- China had 221 IMAX screens in 2014 (2nd to US)

- Prior to 2001 IMAX was an expensive capital investment

- Came up with Digital remastering to convert firms relatively cheaply and quickly

Business Model

- Revenue Sharing

- IMAX would provide free equipment in return for 1/3 of box office receipts – 10-13 years. Also licensed its technology through leases and sales.

- 2009 Avatar grossed $250 million on IMAX

- 1 in 5 selected to shoot with IMAX cameras

You must be logged in to post a comment.